Alibaba: March Earnings And Bridgewater Position (NYSE:BABA)

Robert Way/iStock Editorial via Getty Images

Thesis

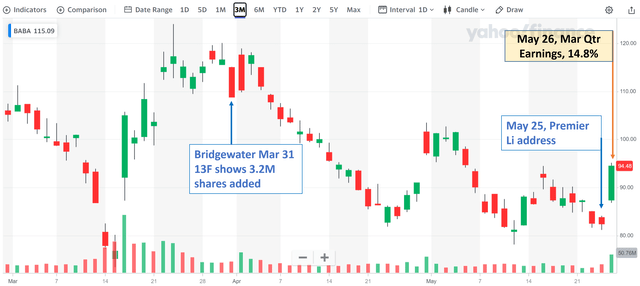

Alibaba Group (NYSE:BABA) stock price surged by almost 15% after it reported is March quarter results on May 26. The results beat both topline and bottom-line expectations. It’s a surprise on one hand given China’s COVID lockdown in key cities such as Shanghai during the past quarter. On the other hand, the better-than-expected results and large price really also seem logical given the events leading to the earnings report on May 26. As such, in this article, I will examine two of the key market events before reviewing earnings because I do not think earnings can be properly interpreted without a broader background.

The first key event involved a large stake increase from Bridgewater. Its most recent 13F disclosure filed on March 31 shows that it increased its BABA position by 3.2M shares, representing an increase of about 75%. Such high conviction from an independent thinker and China expert like Ray Dalio should definitely be part of the BABA thesis.

The second key event involved the radio address given by China Premier Li Keqiang on May 25, the day before the earnings report. We will detail the address later, but the essence is that the country is committed to stabilizing the economy and ensuring reasonable growth ahead.

Under such background, we will then examine BABA’s earnings closely and gain insight into its path forward. The thesis is best captured by the management’s confidence in generating “sustainable and high-quality revenue” and in building “a strong and durable relationship with our consumers and customers.” I share management’s confidence and see the stage all set for BABA to go in 2023.

Yahoo Finance

Ray Dalio’s And “China risk”

Many comments to my earlier BABA articles (or BABA articles in general) evolved around the Chinese government and the CCP more than the stock itself. And the implied argument is that the Chinese government and CCP are a central part, or even 100%, of the investment thesis.

It’s undoubtedly a strong and valid argument. And it’s certainly a good idea to stay clear of BABA (or other Chinese stocks) if you hold this viewpoint. But my view is that political or ideological considerations are only part of the thesis. There are no “good” or “bad” risks in investment – simply risks that are adequately priced or not.

This brings me to Bridgewater and Ray Dalio, who understands both China AND the U.S. deeper than anyone I’ve met or read about. I highly recommend his recent book entitled “The Changing World Order” for readers who are interested in his view about conflicts and interconnectedness between these two top global powers. A few quotes from his book to prepare the background for his BABA positions.

- “I urge those of you who have not spent considerable time in China to look past the caricatured pictures that are often painted by biased parties and rid yourself of any stereotypes you might have that are based on what you thought you knew about the old “communist China” – because they are wrong.

- “Triangulate whatever you are hearing or reading with people who have spent a lot of time in China working with Chinese people.”

- “As an aside, I think the widespread medium distortions and the blind and the near-violent loyalties that stand in the way of the thoughtful exploration of our different perspectives are a frightening sign of our times.”

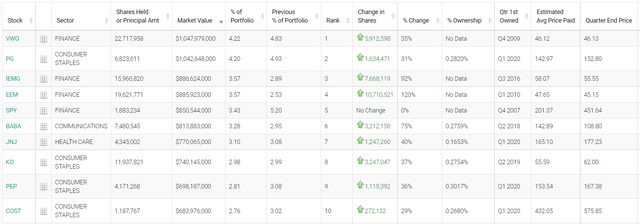

His actions certainly align well with his above views. As you can see from the chart below, his Bridgewater portfolio holds a large position in BABA. The BABA position is currently the sixth-largest position in its $23.5B portfolio. The BABA position is currently worth $813 Million and represents 3.28% of its entire equity portfolio. More tellingly, its March 31 13F disclosed ownership of more than 7.48M shares, a large increase of 75% in terms of shares from the 4.27M shares it disclosed a quarter ago. Such high conviction from Ray Dalio, given his unmatched insights and expertise in China, should not go unnoticed by any BABA investor.

Whalewisdom.com Bridgewater Associates Holdings

Political Climate

Next, the political climate is changing too. In a radio address broadcast on May 25, a day before BABA released its March quarter earnings, China Premier Li Keqiang said the country should push forward to stabilize the economy. More specifically, the premier asked for concrete plans with a clear timeframe, as CGTN news reported (the emphases were added by me):

Chinese Premier Li Keqiang asked for details on how to implement the policies aimed at stabilizing the economy during a State Council meeting on Wednesday. The premier required that the details must be sorted out before the end of May. In order to make sure the half-year targets are met, Li asked the government to better balance between economic development and COVID-19 control, while safeguarding employment and the running of market entities.

Moreover, earlier this month, Chinese Vice Premier Liu He also addressed executives from China’s top tech firms. The vice premier said that the relationship between the government and the firms would be “properly managed” according to the following Reuters report:

BEIJING, May 17 (Reuters) Chinese Vice-Premier Liu He told tech executives on Tuesday that relations between the government and market need to be “properly managed”, the latest sign that authorities are looking to ease a regulatory crackdown on the tech sector.

Against such a broader backdrop, BABA’s March earnings surprise appears less surprising, as we will elaborate next.

March Quarter Earnings

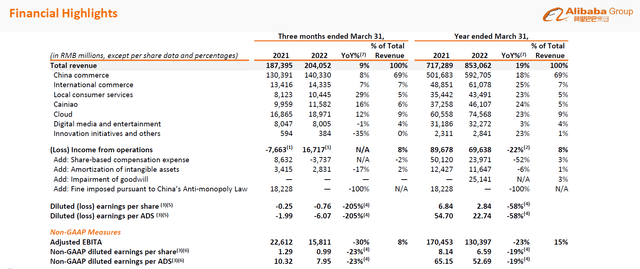

Despite the COVID lockdowns during the past quarter, BABA delivered better-than-expectations results, beating consensus both in terms of topline and bottom line. Total revenue came in at $32.1 billion, representing a growth of 9% and beating the consensus estimate by about $3 billion (about 10%). Diluted EPS came in at $1.25 per share, representing a decline of 23% but beating the consensus estimate by $0.16 (about 13%). As summarized by its CFO Toby Xu (abridged and emphases added by me):

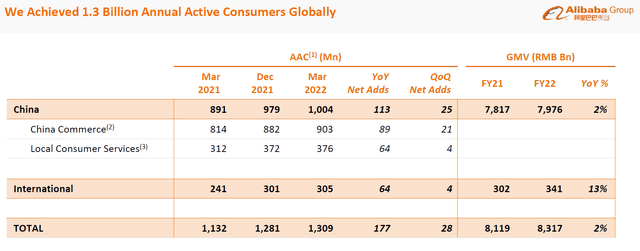

Let me close with a short recap of last fiscal year, and then our outlook… During this past year, we have made a number of achievements that position us well for the future. First, we have reached a historical milestone of over 1 billion annual active consumers in China. Our unique value proposition of having both e-commerce and location-based commerce businesses at scale position us well to serve these 1 billion consumers in China. Second, we are seeing increasing benefit from our development of an integrated intercity and intercity logistic network that allow us of multiple delivery and fulfillment options to our consumers. Lastly, in fiscal 2022, we had spent over RMB 120 billion in technology related costs and expenses that continue to strengthen our leading position in China’s cloud market…

BABA March Earnings Report

BABA March Earnings Report

A couple of highlights that I think are worth noting and indicative of BABA’s future directions:

- As pointed out by the CEO, the 1 billion AACs is a historical milestone. BABA’s ACCs in China, with a net increase of about 113 million in the past year, surpass 1 billion, a mind-boggling number. Globally, AACs grew at a double-digit annual rate of 13.5% and reached 1.31 billion AACs.

- Secondly, another milestone is BABA cloud reported its first profitable fiscal year (while still maintaining its market leadership status in China without a surprise as the CFO commented).

- Finally, its international commerce is a highlight, since its separation from the China commerce, it grew 13% YOY.

Going forward, I see the stage set for BABA to resume its growth for several key considerations. The first reason involves the political climate change mentioned above. I see the worst has passed already. And going forward, I see the government more ‘properly managing’ its tech giants, as the vice-Premier commented. Secondly, BABA’s separation of its China retail and international retail also is a very wise and fundamental important move. It paves a fundamentally better path for BABA forward, with its risks, both business and political, better delineated.

Final Thoughts And Risks

To me, recent events signal the worst of the crackdown for BABA. Its business fundamentals stay strong and even strengthened in some areas during the past one or two years. For potential BABA investors, as Ray Dalio did, I also urge you to look past the stereotypes surrounding the “China risk.” Its separation from China and international retail pave a path forward for its core business with delineated risks. And at the same time, its new business such as cloud began to be profitable and is well positioned for unprecedented growth potential. Yet, it’s still valued only at 12.5x FW PE, even after the large price surge yesterday.

Although, there are risks involved. In the near term, the delisting risk could keep causing large price volatilities. The conflicts. BABA (and other Chinese stocks too) fell or rallied sensitively whenever the Securities and Exchange Commission makes comments about auditing or delisting Chinese firms. Such risks can persist and won’t be completely resolved until China and the US finds a way to better collaborate and defuse the political tension.