China’s factory downturn slows as Covid curbs ease; Brent crude oil hits $124 – business live

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The slump in China’s economy caused by Covid-19 lockdowns may be bottoming out, as authorities prepare to end the restrictions imposed in Shanghai two months ago.

Activity across China’s companies shrank at a slower rate this month — after falling sharply as virus outbreaks led to restrictions in several cities earlier this year– according to the latest survey of purchasing managers across China’s businesses.

China’s factory sector only dipped last month, with its PMI rising to 49.6, from 47.4 in April. That lifted it back towards the 50-point mark showing stagnation.

The services sector struggled more, with the ‘non-manufacturing PMI’ jumping to 47.8 after plunging to 41.9 a month ago. That shows the sector continued to contract, but not as fast.

Zhao Qinghe, senior statistician at China’s National Bureau of Statistics, says:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}“This showed manufacturing production and demand have recovered to varying degrees, but the recovery momentum needs to be strengthened.

The data has lifted hopes for a recovery next month, as Jeffrey Halley of OANDA explains:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;} Both numbers remain below 50.0 and are thus in contractionary territory. But are markedly less so thanks to an easing of restrictions in Beijing and Shanghai.

A less worse than expected set of data has prompted a modest rally in China equities today, holding the promise of an accelerating recovery in June if the virus situation remains benign

Official PMIs from China show improvement in May, but still signals weak business activity.

NBS manufacturing PMI rose to 49.6 from 47.4 in April

NBS non-manufacturing PMI increased to 47.8 in May from April's very poor reading of 41.9

— Hugo Pienaar (@hugopien) May 31, 2022

n","url":"https://twitter.com/hugopien/status/1531482081380941829","id":"1531482081380941829","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"19d8fb2d-5048-4582-a74e-237a8c99433d"}}”>

Official PMIs from China show improvement in May, but still signals weak business activity.

NBS manufacturing PMI rose to 49.6 from 47.4 in April

NBS non-manufacturing PMI increased to 47.8 in May from April’s very poor reading of 41.9

— Hugo Pienaar (@hugopien) May 31, 2022

The purchasing managers' index (#PMI) for #China's non-manufacturing sector came in at 47.8 in May, up from 41.9 in April, the National Bureau of Statistics (NBS) said Tuesday. pic.twitter.com/rUVNofo5CB

— Beijing Business Today (@BusinessBeijing) May 31, 2022

n","url":"https://twitter.com/BusinessBeijing/status/1531479393561812993","id":"1531479393561812993","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"fb0a45b7-91d8-456d-a57b-674c23bb938b"}}”>

The purchasing managers’ index (#PMI) for #China‘s non-manufacturing sector came in at 47.8 in May, up from 41.9 in April, the National Bureau of Statistics (NBS) said Tuesday. pic.twitter.com/rUVNofo5CB

— Beijing Business Today (@BusinessBeijing) May 31, 2022

China's official manufacturing purchasing managers’ index (PMI) rose to 49.6 in May, up from 47.4 in April, while the official non-manufacturing PMI rose to 47.8 from 41.9 last month #China #china #manufacturing #services #PMI https://t.co/1D6UqdgWI1 pic.twitter.com/46S0UfruRs

— SCMP Economy (@scmpeconomy) May 31, 2022

n","url":"https://twitter.com/scmpeconomy/status/1531476520253923328","id":"1531476520253923328","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"1aa16619-178d-4853-8ba9-2d7e52dd803c"}}”>

China’s official manufacturing purchasing managers’ index (PMI) rose to 49.6 in May, up from 47.4 in April, while the official non-manufacturing PMI rose to 47.8 from 41.9 last month #China #china #manufacturing #services #PMI https://t.co/1D6UqdgWI1 pic.twitter.com/46S0UfruRs

— SCMP Economy (@scmpeconomy) May 31, 2022

The recovery should get a lift this week as Shanghai prepares to end its two-month lockdown at midnight.

My colleague Helen Davidson in Taipei explains:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}Shanghai authorities have begun dismantling fences around housing compounds and ripping police tape off public squares and buildings, to the relief of the city’s 25 million residents, before a painful two-month lockdown is lifted at midnight.

On Monday evening, some of the people allowed out of their compounds for brief walks took advantage of suspended traffic to congregate for a beer and ice cream on deserted streets, but there was a sense of wariness and anxiety among residents.

Most will be stuck indoors again until midnight, as they have been for the past two months under a ruthlessly enforced lockdown that has caused income losses, stress and despair to millions struggling to access food or get emergency healthcare.

The prolonged isolation has fuelled public anger and rare protests inside Shanghai and battered the city’s manufacturing and export-heavy economy, disrupting supply chains in China and around the world, and slowing international trade.

Life is set to return to something more like normal from Wednesday, when the passes issued by residential buildings for people to go out for a few hours will be scrapped, public transport will resume and residents can go back to work.

Also coming up today

Inflation in the eurozone is expected to hit a new record high, as the surge in energy costs drive up the cost of living.

The Bank of England will report how many mortgages were approved in April.

Russia’s central bank is releasing an economic stability report. We also find out how Canada, India, Poland and Switzerland’s economies fared in the first three months of the year:

The agenda

- 7.45am BST: French inflation report for May

- 8am BST: Switzerland’s Q1 GDP report

- 8.55am BST: German employment report for May

- 9am BST: Poland’s Q1 GDP report

- 9.30am BST: UK mortgage approvals and consumer credit data for April

- 10am BST: Eurozone inflation report for May

- 1pm BST: India’s Q1 GDP report

- 1pm BST: Bank of Russia holds press conference on Financial Stability Review

- 1.30pm BST: Canada’s Q1 GDP report

- 2pm BST: US house price index

- 3pm: US consumer confidence report from the Conference Board

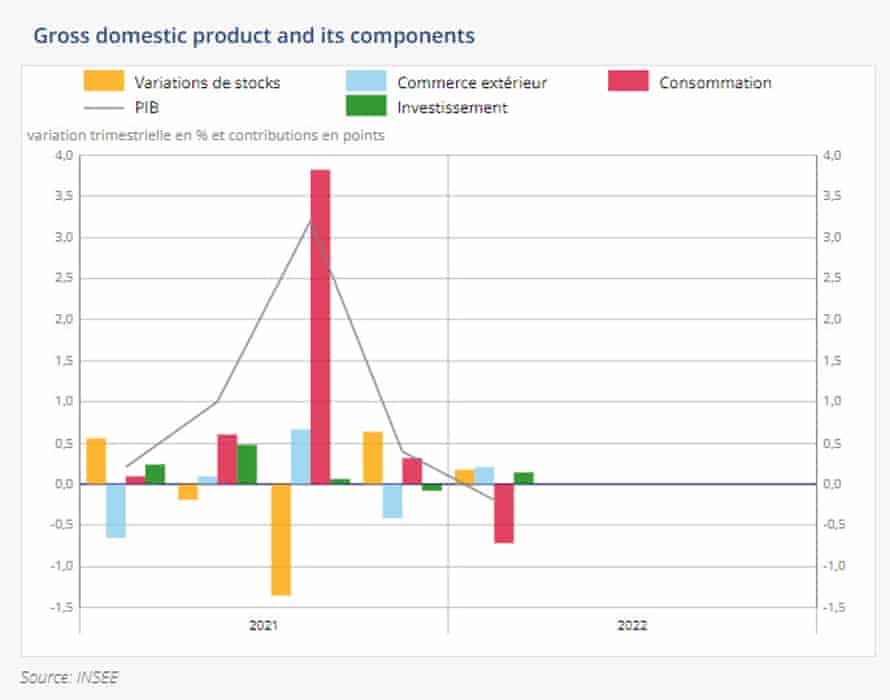

France’s economy is at risk of falling into a recession after shrinking in the first three months of this year.

French GDP fell by 0.2% in January-March, updated figures from statistics body INSEE shows, worse than its initial estimate that GDP was unchanged. That follows 0.2% growth in Q4 2021.

INSEE reported that growth this year was dragged down by weak consumer spending, which fell by 1.5% as households were hit by higher inflation.

Spending on transport equipment (–2.3%), other manufactured goods (–2.1%) and on accommodation and catering ( –3.9%) was particularly weak.

Investment (or gross fixed capital formation [GFCF]) rose by 0.6%, while foreign trade made a positive contribution (with exports rising faster than imports).

French households’ gross disposable income fell by 0.5% in the first quarter, partly because they received a one-off €100 handout last autumn to help with rising prices.

INSEE says:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}This decline is partly mitigated by the revaluation in January of basic pensions, and by the sharp increase in the use of sick leave following the Omicron wave.

⚠️Le PIB révisé en baisse au premier trimestre à -0,2%, le pouvoir d’achat recule nettement à –1,9 %

➡️La France entre en #récession. Le seul moteur de l'économie c'est la consommation (soutenue par les prestations sociales), avec l'#inflation il cale.

✅https://t.co/JYwMjjT3ma— Philippe Herlin (@philippeherlin) May 31, 2022

n","url":"https://twitter.com/philippeherlin/status/1531541016230215682","id":"1531541016230215682","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"9f3d544e-8ef8-49a1-965a-eeb64ef59f7e"}}”>

⚠️Le PIB révisé en baisse au premier trimestre à -0,2%, le pouvoir d’achat recule nettement à –1,9 %

➡️La France entre en #récession. Le seul moteur de l’économie c’est la consommation (soutenue par les prestations sociales), avec l’#inflation il cale.

✅https://t.co/JYwMjjT3ma— Philippe Herlin (@philippeherlin) May 31, 2022

Bad economic news for France this morning as Q1 GDP growth was revised from 0% to -0.2% . So half way to a recession …..

— Shaun Richards (@notayesmansecon) May 31, 2022

n","url":"https://twitter.com/notayesmansecon/status/1531544768752373761","id":"1531544768752373761","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"9a74ea33-fcc3-4dbd-8d0b-7d30d8d62b72"}}”>

Bad economic news for France this morning as Q1 GDP growth was revised from 0% to -0.2% . So half way to a recession …..

— Shaun Richards (@notayesmansecon) May 31, 2022

In another blow, French inflation continued to rise this month.

France’s national consumer price index rose to 5.2% in May from 4.8% in April, hitting its highest since September 1985.

On an EU-harmonised basis, consumer prices by 5.8% over the year, the highest rate since France began using European Union methodology to calculate the readings in the early 1990s.

That’s lower than the UK, where inflation hit 9% in April, with France rolling out a €25bn package of support to cap gas and electricity price increases.

European stock markets have opened lower, with the pan-European Stoxx 600 down 0.5% despite London’s small rally.

#EnDirecto | Apertura de los mercados europeos:

🇩🇪DAX -0,44%

🇪🇺EuroStoxx -0,46%

🇬🇧FTSE +0,17%

🇫🇷CAC -0,31%

🇮🇹FTSE MIB -0,30%https://t.co/S6BlqkhebB

— Radio Intereconomía (@rintereconomia) May 31, 2022

n","url":"https://twitter.com/rintereconomia/status/1531531399726911496","id":"1531531399726911496","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"a2ad2a3b-8a65-49f7-87b4-c649f19d090b"}}”>

#EnDirecto | Apertura de los mercados europeos:

🇩🇪DAX -0,44%

🇪🇺EuroStoxx -0,46%

🇬🇧FTSE +0,17%

🇫🇷CAC -0,31%

🇮🇹FTSE MIB -0,30%https://t.co/S6BlqkhebB

— Radio Intereconomía (@rintereconomia) May 31, 2022

Shares in oil giants Shell (+1.5%) and BP (+1.3%) have been lifted by the rising oil price.

That’s helped to push the blue-chip FTSE 100 index up by 23 points or 0.3% to 7623.

While consumer non-cyclicals (inc. Unilever) and technology stocks are higher in London, real estate, consumer cyclicals and industrial stocks are dipping.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, says it’s a ‘lethargic start’ after EU leaders agreed their plan to block more than two-thirds of Russian oil imports.

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;} Given Russia currently supplies 27% of the EU’s imported oil and 40% of its gas, the FTSE’s tepidness is reflecting anxiety over supply.

The UK is in a better position than some European countries when it comes to reliance on Russia for energy supply, but this doesn’t mean supply concerns will be completely glossed over. The move is likely to create a permanent hike in EU oil prices, and the cost of sourcing is going to rise.

The copper price has touched its highest level in nearly four weeks, after China’s factory slowdown eased.

The relaxation of Covid-19 restrictions could also lead to higher demand for metals such as copper (seen as a gauge of global economic demand).

Three-month copper on the London Metal Exchange rose to $9,587 per tonne this morning, its its highest since May 5.

#London copper prices on Tuesday held steady near a more than three-week high, after better factory activity data and easing of #Covid_19 lockdowns in top metals consumer #China lifted demand prospects: Reuters

— Arab News | Business (@ArabNewsBiz) May 31, 2022

n","url":"https://twitter.com/ArabNewsBiz/status/1531507230545158145","id":"1531507230545158145","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"e2056d26-2ae5-4589-890b-503a01723045"}}”>

#London copper prices on Tuesday held steady near a more than three-week high, after better factory activity data and easing of #Covid_19 lockdowns in top metals consumer #China lifted demand prospects: Reuters

— Arab News | Business (@ArabNewsBiz) May 31, 2022

Discount retailer B&M has sunk to the bottom of the FTSE leaderboard, down 9%, after warning that its profit margins will be squeezed by the cost-of-living crisis.

B&M, which sells a wide range of goods including homeware, DIY, food and gardening equipment, says it may need to mark down prices this year.

Customers may also shift from buying general merchandise (where profit margins are higher) in favour of food and fast-moving consumer goods, says B&M, which saw a boost in sales during pandemic lockdowns when some rivals shops were forced to close.

Trading patterns are expected to remain unpredictable in the year ahead, B&M warned

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}Given the uncertain macroeconomic outlook, it is difficult to predict the net impact of a number of factors such as customer down-trading, category mix shift and the impact of inflation on sales volumes.

It also announced that finance chief Alex Russo would succeed CEO Simon Arora.

Value retailer B&M (#BME) posts ok results for FY to end-March but margin outlook looks low. Sees a 'step back' of 70-130 bps in UK margins as customers trade down and group EBITDA of £550m-£600m.https://t.co/8KLnR9zxn2

— Ian Conway (@SharesMagIan) May 31, 2022

n","url":"https://twitter.com/SharesMagIan/status/1531518938231758848","id":"1531518938231758848","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"d81bb9ae-573e-4046-9dc7-f0fe5c8ca8f6"}}”>

Value retailer B&M (#BME) posts ok results for FY to end-March but margin outlook looks low. Sees a ‘step back’ of 70-130 bps in UK margins as customers trade down and group EBITDA of £550m-£600m.https://t.co/8KLnR9zxn2

— Ian Conway (@SharesMagIan) May 31, 2022

Shares in Unilever have surge 7.5% in early trading, after activist investor Nelson Peltz joined its board, pledging to help drive its strategy, operations, sustainability, and shareholder value.

Switzerland’s economy continued to grow in the first quarter of the year, as its industrial sector led its recovery.

Swiss GDP grew by 0.5% in the first quarter of 2022, accelerating from a 0.2% rise in the last quarter of 2021.

Despite the Ukraine war, and rising inflation, Switzerland’s manufacturers continued to see solid demand for goods such as watches and machinery.

Manufacturing grew by +1.7%, but the services sector was held back by the Omicron wave.

Switzerland’s Federal Statistics Office says:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}While growth slowed in the chemical and pharmaceutical sector, other industries gained significant momentum, underpinned by rising demand in key trading partner countries. This was accompanied by stronger growth in goods exports (+1.4%) than the historical average.

Exports were up for numerous goods including precision instruments, watches and jewellery, machinery and metals.

Goods imports (+6.1%) saw an even sharper rise, largely driven by stronger imports of chemical and pharmaceutical products

Russian energy giant Gazprom says it has fully cut off gas supplies to Dutch gas trader GasTerra because it refused to pay in roubles, as president Putin demanded.

Reuters has the details:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}The new requirements for countries which Moscow deems “unfriendly” were introduced following sweeping sanctions imposed by the West on Russia for what it calls a “special military operation” in Ukraine.

Gazprom said on Tuesday the payments should be made in line with the gas-for-roubles scheme.

“Payments for gas supplied from April 1 must be made in roubles using the new bank details, about which the counterparties were informed in a timely manner,” Gazprom said.

GasTerra, which buys and trades gas on behalf of the Dutch government, said it had made alternative arrangements to cover the 2 billion cubic meters (bcm) of gas it had expected to receive from Gazprom through October.

GasTerra said on Monday it had decided not to adopt the new payment system, which involved setting up accounts to convert euro payments to roubles.

GasTerra will no longer receive gas from Russia's Gazprom from May 31 after refusing to agree to Moscow's demands for payment in roubles, the two companies said https://t.co/L3rmfVYyPF pic.twitter.com/4GUFw2sLLm

— Reuters Commodities (@ReutersCommods) May 30, 2022

n","url":"https://twitter.com/ReutersCommods/status/1531380672585256960","id":"1531380672585256960","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"35421db1-5f2e-46fe-8793-127fca11ce07"}}”>

GasTerra will no longer receive gas from Russia’s Gazprom from May 31 after refusing to agree to Moscow’s demands for payment in roubles, the two companies said https://t.co/L3rmfVYyPF pic.twitter.com/4GUFw2sLLm

— Reuters Commodities (@ReutersCommods) May 30, 2022

The billionaire investor Nelson Peltz has joined the board of consumer goods company Unilever, in the latest sign that he will push the maker of brands ranging from Dove soap to Marmite to shake up its sprawling operations.

Peltz is the founder and chief executive of Trian Fund Management, a $7.4bn (£5.9bn) investment firm that has previously mounted activist campaigns at Unilever’s rivals, including Procter & Gamble, Heinz and Mondelēz.

His investment was widely seen to add pressure on Unilever’s leadership under chief executive Alan Jope. The company has been under pressure after years of poor returns for shareholders: shares in the company are still near a five-year low hit in March, and it did not benefit from the rally in shares during the recovery from the coronavirus pandemic lockdowns.

Unilever said that Trian controls 37.4m Unilever shares, or about 1.5% of the company, as it announced Peltz’s appointment as a non-executive director.

Trian says:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}The Investment Manager has informed the Company’s Board that it believes Unilever has significant potential and Trian looks forward to working collaboratively with Unilever’s management and board to help drive the company’s strategy, operations, sustainability, and shareholder value for the benefit of all stakeholders.

Japan’s factories stumbled in April, in a sign that China’s lockdowns and general supply chain problems hit maufacturers.

Factory output across Japan dropped by 1.3% in April, driven by weaker production of items such as electronic parts and production machinery.

It was the first fall in three months and much weaker than a 0.2% decline expected.

Japan's factory output dropped 1.3% in April as China's COVID lockdowns and wider supply disruptions took a heavy toll on manufacturers, clouding the outlook for the trade-reliant economy https://t.co/wLR3aiYMqe

— Reuters Business (@ReutersBiz) May 31, 2022

n","url":"https://twitter.com/ReutersBiz/status/1531466258092367873","id":"1531466258092367873","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"62848482-c7e7-41ce-8efe-279d560224a3"}}”>

Japan’s factory output dropped 1.3% in April as China’s COVID lockdowns and wider supply disruptions took a heavy toll on manufacturers, clouding the outlook for the trade-reliant economy https://t.co/wLR3aiYMqe

— Reuters Business (@ReutersBiz) May 31, 2022

Acquisition news: UK pharmaceuticals group GSK is taking over biopharmaceutical firm Affinivax in a $3.3bn deal.

Affinivax is pioneering the development of a novel class of vaccines, GSK says, the most advanced of which are next-generation pneumococcal vaccines for infections such as pneumonia, meningitis and sinusitis.

Dr Hal Barron, Chief Scientific Officer and President R&D, GSK, said:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;} “The proposed acquisition further strengthens our vaccines R&D pipeline, provides access to a new, potentially disruptive technology, and broadens GSK’s existing scientific footprint in the Boston area.”

The deal comes as GSK prepares to spin off its consumer healthcare unit, and become an R&D-focused biopharma company.

GSK will pay $2.1bn up front and up to $1.2bn if certain milestones are met.

Oil’s jump to a two-month high will not be welcome news for policymakers already grappling with higher energy prices, says Jim Reid of Deutsche Bank.

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}Part of that increase has come amidst the easing of Covid restrictions in China, but the prospect of an EU embargo on Russian oil has also played a role.

Oh no.. Brent crude's just topped that psychologically-important $124 level…. pic.twitter.com/X3rYwjy280

— David Ingles (@DavidInglesTV) May 31, 2022

n","url":"https://twitter.com/DavidInglesTV/status/1531526003348377602","id":"1531526003348377602","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"75307174-dee4-45bd-a045-eb313ba3d16d"}}”>

Oh no.. Brent crude’s just topped that psychologically-important $124 level…. pic.twitter.com/X3rYwjy280

— David Ingles (@DavidInglesTV) May 31, 2022

The oil price has jumped after European leaders agreed a partial ban on Russian oil imports.

After lengthy talks in Brussels, the EU agreed to an embargo on most Russian oil imports, to cut the finances flowing to Moscow.

But it won’t stop the flow completely. The embargo covers Russian oil brought in by sea. but there’s a temporary exception for pipeline imports, to appease countries such as Hungary who opposed a full ban.

The president of the European Council, Charles Michel, says it will immediately impact 75% of Russian oil imports.

Tonight #EUCO agreed a sixth package of sanctions.

It will allow a ban on oil imports from #Russia.

The sanctions will immediately impact 75% of Russian oil imports. And by the end of the year, 90% of the Russian oil imported in Europe will be banned. pic.twitter.com/uVoVI519v8

— Charles Michel (@eucopresident) May 30, 2022

n","url":"https://twitter.com/eucopresident/status/1531424785464320000?ref_src=twsrc%5Etfw","id":"1531424785464320000","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"1ec7819b-b014-4d80-90ca-e4cb570dfcfe"}}”>

Tonight #EUCO agreed a sixth package of sanctions.

It will allow a ban on oil imports from #Russia.

The sanctions will immediately impact 75% of Russian oil imports. And by the end of the year, 90% of the Russian oil imported in Europe will be banned. pic.twitter.com/uVoVI519v8

— Charles Michel (@eucopresident) May 30, 2022

Our Brussels correspondent Jennifer Rankin reports:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}Volodymyr Zelenskiy had earlier appealed to EU leaders to show unity against Vladimir Putin. At a summit in Brussels, EU leaders had been attempting to find a way to placate the Hungarian prime minister, Viktor Orbán, who has been holding up a deal on the latest sanctions against Putin’s war machine.

Under a compromise plan that was discussed at the summit, Russian oil transported through the Soviet-era Druzhba pipeline for Hungary, the Czech Republic and Slovakia would be exempt from the EU embargo.

In a press conference on Monday night, Michel acknowledged talk of a lack of European unity, adding: “I think that more than ever it is important to show that we are able to be strong, that we are able to be firm, that we are able to be tough in order to defend our values and our interests.”

Partial embargo: Countries that import oil on tankers had initial reservations about an exemption for pipeline oil that would give an advantage to those countries that can continue to import cheaper Russian oil https://t.co/ftIiF9Ebr3

— Kostas Ant Lavdas (@KostasAntLavdas) May 31, 2022

n","url":"https://twitter.com/KostasAntLavdas/status/1531509887259365377?ref_src=twsrc%5Etfw","id":"1531509887259365377","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"d8190f66-3982-431e-9f85-ba64f214d436"}}”>

Partial embargo: Countries that import oil on tankers had initial reservations about an exemption for pipeline oil that would give an advantage to those countries that can continue to import cheaper Russian oil https://t.co/ftIiF9Ebr3

— Kostas Ant Lavdas (@KostasAntLavdas) May 31, 2022

This, and the encouraging signs from China’s economy, has pushed Brent to its highest since early March.

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The slump in China’s economy caused by Covid-19 lockdowns may be bottoming out, as authorities prepare to end the restrictions imposed in Shanghai two months ago.

Activity across China’s companies shrank at a slower rate this month — after falling sharply as virus outbreaks led to restrictions in several cities earlier this year– according to the latest survey of purchasing managers across China’s businesses.

China’s factory sector only dipped last month, with its PMI rising to 49.6, from 47.4 in April. That lifted it back towards the 50-point mark showing stagnation.

The services sector struggled more, with the ‘non-manufacturing PMI’ jumping to 47.8 after plunging to 41.9 a month ago. That shows the sector continued to contract, but not as fast.

Zhao Qinghe, senior statistician at China’s National Bureau of Statistics, says:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}“This showed manufacturing production and demand have recovered to varying degrees, but the recovery momentum needs to be strengthened.

The data has lifted hopes for a recovery next month, as Jeffrey Halley of OANDA explains:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;} Both numbers remain below 50.0 and are thus in contractionary territory. But are markedly less so thanks to an easing of restrictions in Beijing and Shanghai.

A less worse than expected set of data has prompted a modest rally in China equities today, holding the promise of an accelerating recovery in June if the virus situation remains benign

Official PMIs from China show improvement in May, but still signals weak business activity.

NBS manufacturing PMI rose to 49.6 from 47.4 in April

NBS non-manufacturing PMI increased to 47.8 in May from April's very poor reading of 41.9

— Hugo Pienaar (@hugopien) May 31, 2022

n","url":"https://twitter.com/hugopien/status/1531482081380941829","id":"1531482081380941829","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"9c5fe26f-1b96-4fc7-99c0-bb3f2ee32a1a"}}”>

Official PMIs from China show improvement in May, but still signals weak business activity.

NBS manufacturing PMI rose to 49.6 from 47.4 in April

NBS non-manufacturing PMI increased to 47.8 in May from April’s very poor reading of 41.9

— Hugo Pienaar (@hugopien) May 31, 2022

The purchasing managers' index (#PMI) for #China's non-manufacturing sector came in at 47.8 in May, up from 41.9 in April, the National Bureau of Statistics (NBS) said Tuesday. pic.twitter.com/rUVNofo5CB

— Beijing Business Today (@BusinessBeijing) May 31, 2022

n","url":"https://twitter.com/BusinessBeijing/status/1531479393561812993","id":"1531479393561812993","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"22efba24-b43d-4123-8a05-836ebdd7aecb"}}”>

The purchasing managers’ index (#PMI) for #China‘s non-manufacturing sector came in at 47.8 in May, up from 41.9 in April, the National Bureau of Statistics (NBS) said Tuesday. pic.twitter.com/rUVNofo5CB

— Beijing Business Today (@BusinessBeijing) May 31, 2022

China's official manufacturing purchasing managers’ index (PMI) rose to 49.6 in May, up from 47.4 in April, while the official non-manufacturing PMI rose to 47.8 from 41.9 last month #China #china #manufacturing #services #PMI https://t.co/1D6UqdgWI1 pic.twitter.com/46S0UfruRs

— SCMP Economy (@scmpeconomy) May 31, 2022

n","url":"https://twitter.com/scmpeconomy/status/1531476520253923328","id":"1531476520253923328","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"2ce76b96-1e14-4d5f-96fd-d4d681b0049b"}}”>

China’s official manufacturing purchasing managers’ index (PMI) rose to 49.6 in May, up from 47.4 in April, while the official non-manufacturing PMI rose to 47.8 from 41.9 last month #China #china #manufacturing #services #PMI https://t.co/1D6UqdgWI1 pic.twitter.com/46S0UfruRs

— SCMP Economy (@scmpeconomy) May 31, 2022

The recovery should get a lift this week as Shanghai prepares to end its two-month lockdown at midnight.

My colleague Helen Davidson in Taipei explains:

.css-knbk2a{height:1em;width:1.5em;margin-right:3px;vertical-align:baseline;fill:#C70000;}Shanghai authorities have begun dismantling fences around housing compounds and ripping police tape off public squares and buildings, to the relief of the city’s 25 million residents, before a painful two-month lockdown is lifted at midnight.

On Monday evening, some of the people allowed out of their compounds for brief walks took advantage of suspended traffic to congregate for a beer and ice cream on deserted streets, but there was a sense of wariness and anxiety among residents.

Most will be stuck indoors again until midnight, as they have been for the past two months under a ruthlessly enforced lockdown that has caused income losses, stress and despair to millions struggling to access food or get emergency healthcare.

The prolonged isolation has fuelled public anger and rare protests inside Shanghai and battered the city’s manufacturing and export-heavy economy, disrupting supply chains in China and around the world, and slowing international trade.

Life is set to return to something more like normal from Wednesday, when the passes issued by residential buildings for people to go out for a few hours will be scrapped, public transport will resume and residents can go back to work.

Also coming up today

Inflation in the eurozone is expected to hit a new record high, as the surge in energy costs drive up the cost of living.

The Bank of England will report how many mortgages were approved in April.

Russia’s central bank is releasing an economic stability report. We also find out how Canada, India, Poland and Switzerland’s economies fared in the first three months of the year:

The agenda

- 7.45am BST: French inflation report for May

- 8am BST: Switzerland’s Q1 GDP report

- 8.55am BST: German employment report for May

- 9am BST: Poland’s Q1 GDP report

- 9.30am BST: UK mortgage approvals and consumer credit data for April

- 10am BST: Eurozone inflation report for May

- 1pm BST: India’s Q1 GDP report

- 1pm BST: Bank of Russia holds press conference on Financial Stability Review

- 1.30pm BST: Canada’s Q1 GDP report

- 2pm BST: US house price index

- 3pm: US consumer confidence report from the Conference Board